FROM A FLEDGLING organization of five

member-states in 1967, the Association of Southeast Asian Nations

(ASEAN) has evolved into a dynamic force in the global arena. The ASEAN

“solar system” now has 10 countries revolving around its axis. The

analogy is quite apt considering that each of these countries has

different stages of growth and their position relative to the ASEAN

integration initiatives is determined by their level of preparedness to

engage in the envisioned one economic community.

A regional economic integration is the goal

of the ASEAN Economic Community (AEC). This is expected to be fueled

through a single market and production base. However, the gap between

the wealthiest and poorest members continues to pose real challenges

especially in the areas of standards harmonization, tariff reductions,

and the implementation of free trade agreements.

The difficulties notwithstanding, ASEAN continues on its path towards

full integration -- economic, political-security and socio-cultural --

recognizing the value of a strong united region in achieving stability

and prosperity for its member-states. The effects of the various

integration initiatives are already being felt through an increased

intra-ASEAN trade. It is fueling individual country initiatives to boost

productivity and competitiveness and strengthening capabilities to take

advantage of the expanded market.

In the Philippines, the business community is all too aware that the

countdown for the 2015 integration looms large in the horizon. The

potential to grow is certainly there, but taking advantage of these

opportunities requires hard work, preparation, and even organizational

transformations. With just 21 months left for the projected

AEC-integration by December 2015, preparations must now move from

information to action.

The AEC will be a game-changer that requires new rules for engagement and the issues that must be addressed.

KNOW THE RULES

ASEAN member-countries have made significant

progress in the lowering of intra-regional tariffs through the Common

Effective Preferential Tariff (CEPT) Scheme for ASEAN Free Trade Area

(AFTA). In the 2013 Joint Meeting in Singapore, key achievements were

highlighted, among which were the implementation of the ASEAN Harmonized

Tariff Nomenclature (AHTN) 2012/1 by all 10 ASEAN member-states,

completion of the ASEAN Single Window Pilot Project Component 2, and the

commencement of the ASEAN Customs Transit System component under the

ASEAN Regional Integration Support by the EU Program.

With the customs integration and standards harmonization on track, it is

expected that the trade barriers (both tariff and non-tariff) will be

eased. How will Philippine businesses take advantage of the open region?

What are these trade agreements and how will they impact on business

decisions to engage in the ASEAN market? What industries will most

likely thrive in these developments... and what happens to the rest?

KNOW THE RISKS

The ASEAN Comprehensive Investment Agreement

(ACIA) is a mechanism that is expected to create a free and open

investment regime/environment in the context of an integrated economic

community. It is ASEAN’s response to increase global competition and to

enhance the attractiveness of ASEAN as a single investment destination.

There are never guarantees for engaging in global and regional business

initiatives, but having a mechanism such as ACIA lessens the

uncertainties and provides more confidence that when investments are

made, there are rules that can both enable and protect the investors and

the countries they will put their money into.

What are the provisions of the ACIA and how can businesses take

advantage of the opportunities? How can the government make the

Philippines a sound investment proposition? How can the local businesses

expand their market reach through linkages with potential business

partners in the region? How will such investments and partnerships be

enabled, protected and strengthened?

KNOW THE REGION

A combined population of approximately 600

million, with an aggregate GDP of at least $2.2 trillion and trading at

over $2.4 trillion -- this is the combined might of the ASEAN countries.

This is what its trading partners are excited about -- and this is the

opportunity that businesses can look forward to when they engage in this

market. The time to look for prospects is now -- 2015 is just around

the corner and companies need to work double time to be prepared for

this new wave.

Where do we start? Which among these ASEAN member-states provide the

most attractive environment for business to develop and thrive? How do

companies take advantage of this expanded playing field?

KNOW THE RESOURCES

With the ASEAN integration and the promise

of a robust economy in the region, it is expected that retention of

skilled human resource will pose a major challenge for the countries.

People will go where the compensation is better, where their

competencies can be put to good use and where their career growth will

be accelerated.

What impact will the free movement of people in the region have on

productivity and competitiveness of each member-country? Will the more

progressive member-state have the distinct advantage of securing their

needed human resource and unwittingly create problems for the

less-developed economies? What human resource strategy should be adopted

to mitigate the negative effects?

KNOW THE REWARDS

There are many challenges in the integration

but there are also stories of successful voyagers who rode the waves of

change and continue to take advantage of the oceans of opportunity.

Bigger market, economies of scale, better profits -- these are part of

the gains that can be achieved in the integration but only if the

business ships sail.

Change is coming. ASEAN integration is happening. There is no turning

back and staying put is no longer an option. We must learn to adapt to

the new order, identify opportunities, improve our capacities and

capabilities, reconstruct our competencies and get ready to swim from a

small pond to the big ocean. This journey will not be for the

faint-hearted so let’s be brave and take intelligent risks.

The Management Association of the Philippines (MAP) is doing its share

to promote awareness of the ASEAN integration and how business can get

ready to engage. We invite you to attend MAP’s forum series on the AEC

Rules of Engagement to be held on April 29, June 24, August 26 and Oct.

28. Contact the MAP Secretariat via 751-1149 to 52 or mapsecretariat@gmail.com for more details.

(The author is the Chairwoman of the MAP ASEAN Integration Committee

and the MAP CEO Conference Committee. She is the President and CEO of

Health Solutions Corporation. Send feedback at mapsecretariat@gmail.com and alma.almadrj@gmail.com. For previous articles, visit map.org.ph.)

Monday, March 31, 2014

Thursday, March 27, 2014

As BRICS grow up, 10 upstarts emerge

PARIS -- Indonesia, Bangladesh and

Ethiopia are among 10 countries set to take over as emerging economies

from the powerful BRICS nations as they struggle with growing pains, a

French credit body said on Tuesday.

"After 10 years of frenetic growth" the big five emerging economies of Brazil, Russia, India, China and South Africa -- the BRICS -- "are slowing down sharply," the French trade credit and insurance group Coface said.

In a report entitled "Coface identifies 10 emerging countries hot on the heels of the BRICS," the organization said that average economic growth by the BRICS this year would be 3.2 percentage points less than the average in the last 10 years.

But "at the same time, other emerging countries are accelerating their development," it said.

The growth of emerging economies and the effect this has on world trade flows is closely analyzed by economists because of the huge impact on every aspect of the global economy and power balances.

Coface broke the 10 new emerging economies it has identified into two groups.

The first comprises Peru, the Philippines, Indonesia, Colombia and Sri Lanka, which it named the PPICS. They had "strong potential confirmed by a sound business environment," Coface said.

The second group comprises Kenya, Tanzania, Zambia, Bangladesh and Ethiopia. But these countries are marked by "very difficult or extremely difficult business environments which could hamper their growth prospects," Coface said.

However, the head of country risk at Coface, Julien Marcilly, said that in 2001 "the quality of governance in Brazil, China, India and Russia was comparable to that of Kenya, Tanzania, Zambia, Bangladesh and Ethiopia today."

But the 10 "new emerging countries" currently accounted for only 11% of the world population whereas the BRICS had accounted for 43% of the population in 2001.

The total GDP of the new 10 was only 70% of the output of the BRICS in 2001, and they had a current account deficit of about 6% of GDP whereas the BRICS had run a surplus on average.

On a positive note, the new 10 had inflation which was about 2.8 percentage points lower than BRIC inflation in 2001, and their public debt was about 40% of output compared with 54% for the BRICS at that time.

Mr. Marcilly said that the BRICS were moving into a new phase since their exports were becoming less competitive, and because they were not yet competitive in offering products with very high added value.

This was why Coface had set out to identify the next wave of driving emerging markets, looking for potential annual growth exceeding 4%, a diversified economy without undue dependence on the sale of raw materials, and some capacity to absorb economic shocks. These had to be matched by a financial system capable of supporting investment, but without raising overheating risks.

The chief economist at Coface, Yves Zlotowski, said they had tried to combine measures of growth potential and risk potential. -- AFP

SOURCE: Businessworld

"After 10 years of frenetic growth" the big five emerging economies of Brazil, Russia, India, China and South Africa -- the BRICS -- "are slowing down sharply," the French trade credit and insurance group Coface said.

In a report entitled "Coface identifies 10 emerging countries hot on the heels of the BRICS," the organization said that average economic growth by the BRICS this year would be 3.2 percentage points less than the average in the last 10 years.

But "at the same time, other emerging countries are accelerating their development," it said.

The growth of emerging economies and the effect this has on world trade flows is closely analyzed by economists because of the huge impact on every aspect of the global economy and power balances.

Coface broke the 10 new emerging economies it has identified into two groups.

The first comprises Peru, the Philippines, Indonesia, Colombia and Sri Lanka, which it named the PPICS. They had "strong potential confirmed by a sound business environment," Coface said.

The second group comprises Kenya, Tanzania, Zambia, Bangladesh and Ethiopia. But these countries are marked by "very difficult or extremely difficult business environments which could hamper their growth prospects," Coface said.

However, the head of country risk at Coface, Julien Marcilly, said that in 2001 "the quality of governance in Brazil, China, India and Russia was comparable to that of Kenya, Tanzania, Zambia, Bangladesh and Ethiopia today."

But the 10 "new emerging countries" currently accounted for only 11% of the world population whereas the BRICS had accounted for 43% of the population in 2001.

The total GDP of the new 10 was only 70% of the output of the BRICS in 2001, and they had a current account deficit of about 6% of GDP whereas the BRICS had run a surplus on average.

On a positive note, the new 10 had inflation which was about 2.8 percentage points lower than BRIC inflation in 2001, and their public debt was about 40% of output compared with 54% for the BRICS at that time.

Mr. Marcilly said that the BRICS were moving into a new phase since their exports were becoming less competitive, and because they were not yet competitive in offering products with very high added value.

This was why Coface had set out to identify the next wave of driving emerging markets, looking for potential annual growth exceeding 4%, a diversified economy without undue dependence on the sale of raw materials, and some capacity to absorb economic shocks. These had to be matched by a financial system capable of supporting investment, but without raising overheating risks.

The chief economist at Coface, Yves Zlotowski, said they had tried to combine measures of growth potential and risk potential. -- AFP

SOURCE: Businessworld

Monday, March 24, 2014

The failure of ASEAN leadership?

CANBERRA, Australia – It

was a packed auditorium – a surprisingly gentle and curious audience at

the Australian National University (ANU) looking for reasons to be

excited about the Association of Southeast Asian Nations (ASEAN), a

10-member grouping of more than 630 million people that represents

Australia’s 2nd largest trading partner.

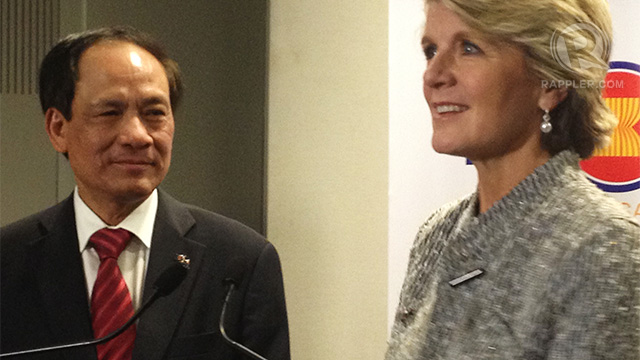

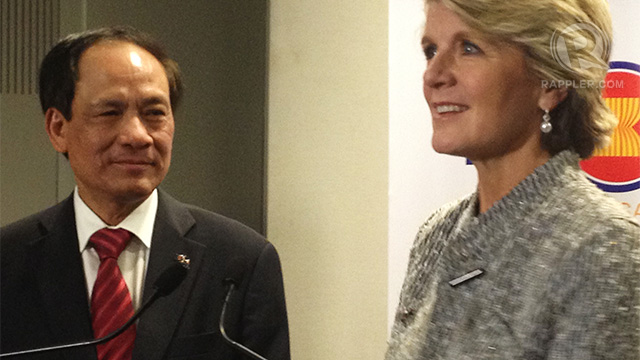

40 YEARS. ASEAN Sec Gen Le Luong Minh with Australian Foreign Minister Julie Bishop

40 YEARS. ASEAN Sec Gen Le Luong Minh with Australian Foreign Minister Julie Bishop

Yet, Vietnamese career diplomat Le Luong Minh, who took

over the leadership of ASEAN last year, couldn’t help but disappoint

them because in many ways he represents much of what’s wrong with ASEAN

today.

ASEAN Secretary-General Minh opened with a speech that did

little to excite the audience. He focused on ASEAN’s 6 pillars when it

was formed in 1967 and its most ambitious project since then – creating

one regional economic grouping, the ASEAN Economic Community (AEC)

slated to come together by December 2015.

Someone asked about tensions between Australia and

Indonesia, ASEAN’s largest member, over asylum seekers and recent

wiretapping charges from NSA classified documents.

“I hope these bilateral issues can be resolved amicably,”

said ASEAN’s leader. “We have not seen any negative impact of that

bilateral relationship on the ASEAN-Australian partnership.”

On ASEAN’s most contentious issue – the conflict between

China and many ASEAN member countries in the South China Sea, Minh said,

“ASEAN is of the view that it needs to be resolved, but it can only be

resolved, and it should only be resolved, between the parties

concerned.”

Minh was safe, uninspiring and bureaucratic. ASEAN

insiders say it’s the luck of the draw, and that the rotating head of

ASEAN moves from a politician like former Thai Foreign Minister Surin

Pitsuwan, who can inspire outside interest, to a bureaucrat who can set

the ASEAN house in order like Minh. From 2004-2011, Minh was Vietnam’s

Permanent Representative to the United Nations while at times

concurrently his country's Deputy Minister for Foreign Affairs.

Unfortunately, he's also ASEAN's least likely salesman.

Dynamic time

Yet, it’s an exciting and dynamic time when a single,

liberalized ASEAN could boost investments significantly. There’s also an

opportunity for ASEAN to provide much needed leadership at a time of

shifting geo-political power.

ASEAN is at a crossroads. Created at a time of global

dominance by the United States, times have changed - with economic power

shifting to China. Instead of taking leadership, ASEAN is in danger of

becoming a low-intensity proxy battlefield.

Nations like the Philippines, Malaysia and Indonesia are

unprepared for open conflict with China or even for negotiating with

China over the South China Sea. Many ASEAN nations turn to the United

States for defense support. At the same time, ASEAN’s poorer nations,

Cambodia, Laos and Myanmar, have become so dependent on China that

analysts call them “client states of Beijing.”

This leaves an opening for Australia, ASEAN’s 1st dialogue partner.

“ASEAN does have an

identity in Australian diplomacy, and it’s a positive one,” said Senator

Brett Mason, the Parliament Secretary to the Minister for Foreign

Affairs, who acknowledged the changing global power structures and

Australia’s shifting focus to Asia. “It’s a forum that could be used

more creatively and more fully, but I don’t think it’s ineffective.”

I’ve been reporting on ASEAN since 1987. I was there in

the late 1990s when Cambodia, Laos, Vietnam and Myanmar were admitted in

the grouping, creating a three-tiered system because these economies

lagged far behind original members Indonesia, Thailand, Malaysia, the

Philippines and even more affluent Brunei and Singapore.

Like many Asians, I hoped constructive engagement would be

a different way to push reforms, more effective than the

confrontational push from the West, but decades later, constructive

engagement remains an excuse – a failure of leadership. Reforms in

Myanmar, which was the main focus of constructive engagement, were

fueled by an internal process - with little help from ASEAN.

During the financial crisis of 1997, which started in

Thailand and spread to Indonesia, the nations turned, not to ASEAN, but

to the International Monetary Fund (IMF). When smog and haze from forest

fires in Indonesia that same year engulfed cities in Malaysia and

Singapore, ASEAN proved incapable of working together to prevent this

near-annual event that continues to plague the region today.

In 1999, ASEAN was criticized for failing to hold

Indonesia accountable for what was effectively a scorched earth policy

in East Timor. Leadership then came from Australia, which led INTERFET,

an international non-UN peacekeeping force.

In the late 2000s under pressure from some members, ASEAN

formed a human rights body that’s stayed largely silent on ongoing human

rights violations within ASEAN, like in Vietnam or the Rohingyas in

Myanmar.

Fissures over China

Dealing with China clearly shows the fissures inside

ASEAN. At the July, 2012 meeting in Cambodia, conflict erupted openly.

For the first time ever, the foreign ministers failed to agree on a

joint statement - with Filipino officials storming out of the meeting.

Other ASEAN states accused host Cambodia of working against ASEAN

interests by protecting China, Cambodia’s largest trading partner. Two

months later, Cambodia announced $500 million in new assistance from

China.

While largest nation and founding member Indonesia tried

to use shuttle diplomacy for a satisfactory agreement, ASEAN again fell

short of leadership.

Still, Australian officials seem optimistic.

On March 19, Australian Foreign Minister Julie Bishop

hosted ASEAN’s Secretary-General Minh for the 40th anniversary of a

partnership she says now prioritizes trade, investment, regional

security and education.

40 YEARS. ASEAN Sec Gen Le Luong Minh with Australian Foreign Minister Julie Bishop

40 YEARS. ASEAN Sec Gen Le Luong Minh with Australian Foreign Minister Julie Bishop

“The extent of government contact – economic, financial –

really is at a much higher level now than a decade before that,” a

senior foreign affairs official told me. “Building ties just below the

political level, senior level official contact, over the last decade has

given our relationship a lot more ballast than ever before.”

The problem lies in two

areas: ASEAN makes decisions based on consensus, unwieldy in today’s

fast-moving world and in an organization that spans a wealth gap from

Singapore to Laos; and that wealth gap leads to differences in

leadership experience and style.

Cambodia, Laos, Vietnam and Myanmar tend to have fewer

officials capable of participating fully in meetings held in English.

The most progressive of these nations, Vietnam, used government money to

train a new generation of foreign service diplomats like Minh.

Consensus not enough

Still, the skills needed for consensus building are not

enough to inspire faith in the ASEAN way, and senior officials who have

led ASEAN, with few exceptions, have not had the charisma or status to

demand necessary meetings with heads of states.

In order to effectively push forward an ambitious ASEAN

agenda of one market, ASEAN must move faster, and its leader must lead –

not just within ASEAN but among its dialogue partners and potential

investors.

“While there’s so much criticism about ASEAN in terms of

leadership, ASEAN is all we have to work with,” said Deakin University’s

Dr. Sally Wood. “I don’t know if they ever really expected that they

would reach this level of centrality. There are so many contending

national interests in the region. So that makes it very challenging for

ASEAN to be able to speak with one voice.”

ASEAN Sec-Gen Minh is trying to fill a tall order, and

insiders say his experience is helping build the organization behind the

scenes. At ANU, he said he’s optimistic that the economic integration

of ASEAN, which promises a single market and a highly competitive

region, will happen as scheduled on December, 2015.

“ASEAN has implemented about 80% of all the measures,” he told the audience at ANU.

Not all agree.

“We’ve got to be realistic. I cannot see that this is

going to happen,” said Professor Andrew Walker, Acting Dean of ANU

College of Asia and the Pacific.

“It looks unlikely that AEC 2015 will be met,” added Wood.

“Perhaps it doesn’t matter that it won’t be realized in 2015, but that

ASEAN is working on it.” - Rappler.com by

Maria A. Ressa

Phl least attractive

University of the Philippines (UP) Professor Benjamin Diokno has

submitted a study that the Philippines will be the least attractive

investment destination in Association of Southeast Asian Nations (ASEAN)

once it formally integrates as an emerging bloc in 2015.

Diokno pointed out that the Philippines does not have a good governance record and does not have a favorable tax regime. The Philippines is lagging behind its Asean neighbors in infrastructure. For this reason, the Philippines will be the least preferred investment destination.

Diokno pointed out too that among ASEAN-5 economies, the Philippines has the biggest corporate tax rate at 30 percent as compared to Singapore’s 17 percent and Thailand’s 20 percent. He also stated that the conflict between the high corporate income tax (CIT) rate and the low tax effort can be attributed to rampant smuggling; the proliferation of redundant fiscal incentives which has been estimated, conservatively, at one percent of gross domestic product (GDP); and poor tax administration.

Several lawmakers have proposed lowering the corporate income tax rate to 25 percent. Also still pending are bills to rationalize fiscal incentives. Tax administration must be further improved to at least 15 percent of GDP. After four years, that appears to be difficult to achieve.

BIR Commissioner Kim Jacinto Henares is a permanent fixture in our annual top 10 performances of government officials. She has increased tax collections every year and has a towering reputation for being immune to compromise. There has only been one criticism — that is of not applying the law equally to subjects of the same class.

A 3rd Malampaya contractor has been slapped with tax evasion charges. What about the hundreds of contractors of other high profile government projects? Are Solenn Heusaff and Judy Ann Santos really the only A-List media personalities who have not filed the correct returns? A Luxury car dealer has been assessed with back taxes but Mercedes Benz, BMW, Lexus, Rolls Royce, Jaguar, Ferrari, among others, have not been touched.

Department of Social Welfare and Development (DSWD) Secretary Dinky Soliman is now investigating the matter to find out the extent of the dumping and where did the rotten goods come from.

Meanwhile, Secretary Edwin Lacierda reported that out of the P25 billion in pledges by foreign governments, only P600 million have been received.

The funds were released through 18 foundations and non-governmental organizations (NGOs), some of which were identified with Janet Lim-Napoles. The funds came from the Priority Development Assistance Fund (PDAF) of the lawmakers, with P25 million coming from Disbursement Acceleration Program (DAP).

The COA audit report said the memorandum of agreement between NCMF, the lawmakers, and the NGOs lacked certain requirements and even supporting documents prescribed by COA Circular No. 2007-001.

The congressmen involved are Maximo Rodriguez (Abante Mindanao), Nelson Collantes (Kaagapay - Batangas), Homer Mercado (1-Utak), Michael Angelo Rivera (1-Care), Jose Benjamin Benaldo (Cagayan de Oro City), Justice Marc Chipeco (Calamba City), Jonathan Yambao (Zamboanga Sibugay), Angelo Palmones (Agham), Nur Ana Sahidullah (Sulu), Isidro Lico (Ating Koop), Neil Benedict Montejo (An Waray), Erico Basilo Fabian (Zamboanga City), Nicanor Briones (Agap), Yevgeny Vicente Emano (Misamis Oriental), Daryl Grace Abayon (Aangat Tayo), Raymond Democrito Mendoza (TUCP), Antonio Kho (Senior Citizens), Mariano Piamonte (A Teacher), Lorenzo Tañada III (Quezon), Salvador Cabaluna III (1-Care), Maria Isabel Climaco (Zamboanga City), Sharon Garin (AAMBIS-OWA), Ponciano Payuyo (Apec), Hajiman Hataman-Salliman (Basilan), Simeon Datumanong (Maguindanao), Cesar Jalosjos (Zamboanga del Norte), Franklin Bautista (Davao del Sur), Fatima Aliah Dimaporo (Lanao del Norte), Arnulfo Go (Sultan Kudarat), Bernardo Vergara (Baguio City), Romeo Jalosjos Jr. (Zamboanga Sibugay), Teodorico Haresco (Ang Kasangga), Rosendo Labadlabad (Zamboanga del Norte), Arturo Robes (San Jose del Monte City), and Anthony Golez (Bacolod City).

COA also released an audit report on P100 million released by congressmen to the Philippine Forest Corporation (PhilForest) that also used NGOs.

Meanwhile, the COA also released an audit report that 141 congressmen had funneled their PDAF allocation through the Technology Resource Center (TRC). They were implemented by NGOs not connected with Napoles.

Department of National Defense Secretary Voltaire Gazmin confirmed the arrest. President Aquino said this is a big blow to the communist rebels since Benito Tiamson is chairman of the CPP and heads the NPA. This is probably the big fish that President Aquino said would be arrested. There is a P5.6 million reward for Tiamson.

Lawyers for the Tiamsons claimed that their arrest was illegal because they were covered by the Joint Agreement on Safety and Immunity Guarantee (JASIG), and were consultants in the peace talks. The Tiamsons are now detained at Camp Crame.

Their arrest order was issued by the Regional Trial Court (RTC) of Laoang in Samar on charges of multiple murder and frustrated murder cases.

Tidbits: PDEA-Albay provincial officer Arnel Estrellado was shot five times by two men on a motorcycle in Sorsogon City.

India is now polio free, one of the greatest medical victory — millions have been vaccinated.

Greetings to women achievers — Senator Cynthia Villar, Lily Monteverde, Rep. Lucy Torres-Gomez, Rep. Leni Robredo, Prof. Miriam Coronel Ferrer.

SEARCH FOR TRUTH By Ernesto M. Maceda (The Philippine Star)

Diokno pointed out that the Philippines does not have a good governance record and does not have a favorable tax regime. The Philippines is lagging behind its Asean neighbors in infrastructure. For this reason, the Philippines will be the least preferred investment destination.

Diokno pointed out too that among ASEAN-5 economies, the Philippines has the biggest corporate tax rate at 30 percent as compared to Singapore’s 17 percent and Thailand’s 20 percent. He also stated that the conflict between the high corporate income tax (CIT) rate and the low tax effort can be attributed to rampant smuggling; the proliferation of redundant fiscal incentives which has been estimated, conservatively, at one percent of gross domestic product (GDP); and poor tax administration.

Several lawmakers have proposed lowering the corporate income tax rate to 25 percent. Also still pending are bills to rationalize fiscal incentives. Tax administration must be further improved to at least 15 percent of GDP. After four years, that appears to be difficult to achieve.

BIR Commissioner Kim Jacinto Henares is a permanent fixture in our annual top 10 performances of government officials. She has increased tax collections every year and has a towering reputation for being immune to compromise. There has only been one criticism — that is of not applying the law equally to subjects of the same class.

A 3rd Malampaya contractor has been slapped with tax evasion charges. What about the hundreds of contractors of other high profile government projects? Are Solenn Heusaff and Judy Ann Santos really the only A-List media personalities who have not filed the correct returns? A Luxury car dealer has been assessed with back taxes but Mercedes Benz, BMW, Lexus, Rolls Royce, Jaguar, Ferrari, among others, have not been touched.

Relief goods dumping

Officials of the United Nations World Food Programme (WFP) have

complained over the dumping of food and other relief items in Palo,

Leyte. Palo Mayor Remedios L. Petilla explained that 4 sacks of rice and

2 sacks of used clothing were dumped because they were rotten.Department of Social Welfare and Development (DSWD) Secretary Dinky Soliman is now investigating the matter to find out the extent of the dumping and where did the rotten goods come from.

Meanwhile, Secretary Edwin Lacierda reported that out of the P25 billion in pledges by foreign governments, only P600 million have been received.

P515 million pork scam

The Commission on Audit (COA) has released a new audit report on a

P515-million pork scam released through the National Commission on

Muslim Filipinos (NCMF), an agency under the Office of the President

headed by former elections commissioner Mehol Sadain. Two senators and

38 former and incumbent congressmen are involved.The funds were released through 18 foundations and non-governmental organizations (NGOs), some of which were identified with Janet Lim-Napoles. The funds came from the Priority Development Assistance Fund (PDAF) of the lawmakers, with P25 million coming from Disbursement Acceleration Program (DAP).

The COA audit report said the memorandum of agreement between NCMF, the lawmakers, and the NGOs lacked certain requirements and even supporting documents prescribed by COA Circular No. 2007-001.

The congressmen involved are Maximo Rodriguez (Abante Mindanao), Nelson Collantes (Kaagapay - Batangas), Homer Mercado (1-Utak), Michael Angelo Rivera (1-Care), Jose Benjamin Benaldo (Cagayan de Oro City), Justice Marc Chipeco (Calamba City), Jonathan Yambao (Zamboanga Sibugay), Angelo Palmones (Agham), Nur Ana Sahidullah (Sulu), Isidro Lico (Ating Koop), Neil Benedict Montejo (An Waray), Erico Basilo Fabian (Zamboanga City), Nicanor Briones (Agap), Yevgeny Vicente Emano (Misamis Oriental), Daryl Grace Abayon (Aangat Tayo), Raymond Democrito Mendoza (TUCP), Antonio Kho (Senior Citizens), Mariano Piamonte (A Teacher), Lorenzo Tañada III (Quezon), Salvador Cabaluna III (1-Care), Maria Isabel Climaco (Zamboanga City), Sharon Garin (AAMBIS-OWA), Ponciano Payuyo (Apec), Hajiman Hataman-Salliman (Basilan), Simeon Datumanong (Maguindanao), Cesar Jalosjos (Zamboanga del Norte), Franklin Bautista (Davao del Sur), Fatima Aliah Dimaporo (Lanao del Norte), Arnulfo Go (Sultan Kudarat), Bernardo Vergara (Baguio City), Romeo Jalosjos Jr. (Zamboanga Sibugay), Teodorico Haresco (Ang Kasangga), Rosendo Labadlabad (Zamboanga del Norte), Arturo Robes (San Jose del Monte City), and Anthony Golez (Bacolod City).

COA also released an audit report on P100 million released by congressmen to the Philippine Forest Corporation (PhilForest) that also used NGOs.

Meanwhile, the COA also released an audit report that 141 congressmen had funneled their PDAF allocation through the Technology Resource Center (TRC). They were implemented by NGOs not connected with Napoles.

Top CPP-NPA leaders arrested

Two top Communist Party of the Philippines-New People’s Army

(CPP-NPA) leaders were arrested by Philippine Army (PA) elements in

Carcar, Cebu, together with 6 others. Benito Tiamzon, the head of the

CPP-NPA and his wife, Wilma Austria.Department of National Defense Secretary Voltaire Gazmin confirmed the arrest. President Aquino said this is a big blow to the communist rebels since Benito Tiamson is chairman of the CPP and heads the NPA. This is probably the big fish that President Aquino said would be arrested. There is a P5.6 million reward for Tiamson.

Lawyers for the Tiamsons claimed that their arrest was illegal because they were covered by the Joint Agreement on Safety and Immunity Guarantee (JASIG), and were consultants in the peace talks. The Tiamsons are now detained at Camp Crame.

Their arrest order was issued by the Regional Trial Court (RTC) of Laoang in Samar on charges of multiple murder and frustrated murder cases.

Tidbits: PDEA-Albay provincial officer Arnel Estrellado was shot five times by two men on a motorcycle in Sorsogon City.

India is now polio free, one of the greatest medical victory — millions have been vaccinated.

Greetings to women achievers — Senator Cynthia Villar, Lily Monteverde, Rep. Lucy Torres-Gomez, Rep. Leni Robredo, Prof. Miriam Coronel Ferrer.

SEARCH FOR TRUTH By Ernesto M. Maceda (The Philippine Star)

March 16, 2021

DON’T WORRY. This is not one of those doomsday scenarios. March 16 is a day of no significance in the Philippines. Most of us think so.

2021 is just seven years from now. This article is about an event that should be a reason to celebrate in a big way if we just realize its historical significance. Thus, it is written with the hope that various sectors in our society think about how we are going to celebrate this important event for the Philippines and the world.

March 16, 2021 marks the 500th anniversary of the discovery of the Philippines by Ferdinand Magellan (known to the Spanish and Portuguese speaking countries as Fernando de Magallanes and Fernao de Magalhaes). By citizenship he was Portuguese, born and grew up in Portugal and even became a page to the Queen.

The date also marks an important achievement of mankind in proving that the world is round. Up to that time, “common” knowledge was that the world was flat. Not only that, it was the first time that men circumnavigated the world.

Such a feat has been attributed to Magellan (though he was killed in Mactan, Cebu) as the leader of that famous expedition. Some claimed though that he doesn’t deserve such honor since he did not live to complete the voyage, but it should belong to the few of his crew (18 of the original 260) belonging to the Armada de Maluco who managed to go back to Spain.

Some historians do say that he still deserves the honor since, as a young soldier of the Portuguese crown, he served in Malacca which at that time belonged to Portugal. But was it really Magellan who was the first to do it, or the 18 who returned to Spain?

ENRIQUE, THE SLAVE

On March 25, 1505, the young Magellan served the Portuguese crown and sailed with Portugal’s first war fleet to reach the East. In the process, the Portuguese expedition conquered Goa and Malacca. It was in Malacca that Magellan purchased a Malay slave that he gave the name Enrique. Because of some problem, Magellan was sent back to Portugal and brought his slave with him.

It was in Malacca too that Magellan heard about the Isles of Gold, situated northeast of the Malay Peninsula. It was reported that he made an authorized trip to these Isles of Gold (or somewhere close by) that earned him an administrative case and caused his repatriation.

At that time, Malacca (Melaka in present Malaysia) was a thriving Portuguese port that served as an entrepot for goods coming from China and the rest of present day Southeast Asia. It was there that traders from India and the Middle East came to exchange or buy goods for their lucrative trading operations in their home countries, Europe, and in the countries where they made ports of call. Among those traded “goods” were slaves.

Back in Portugal, Magellan hatched the plan to sail to the Spice Islands by going west. He presented his plan to the King of Portugal but did not get support. Frustrated, he went to Spain to present his plan to King Charles and support was granted.

It is interesting to point out that part of the group of Magellan’s expedition when he left Spain (Seville in particular) was his slave Enrique. Enrique is reported to have been Malay, meaning a Malaysian in today’s parlance. This may not hold water because how can someone of their own blood be sold in a slave market right on their own soil? It would be unthinkable for a Roman to be sold as a slave on Roman soil. Thus, slaves sold in Roman markets were foreigners (blacks from Africa, whites from the present day British Isles, and barbarians). Let’s just leave this point for now.

When Magellan’s expedition discovered what we now call the Philippine Islands, Enrique became very handy because he understood the language of the people of the islands. Thus, he provided a very important point of communication between Magellan’s crew and the natives. Finally, they reached Cebu and that fateful day when Magellan went to Mactan to battle with Lapu-Lapu and he met his final destiny. So the Spaniards hurriedly scampered away when the Cebuanos were ready for the kill. Enrique took that opportunity to abandon ship. In doing so, did Enrique finally connect back with his roots?

From Pigeffeta’s accounts on Magellan’s expedition, he tells us that they actually saw and met foreign traders in Cebu and slaves were part the commodities they carried in their boats. We also know from our history that Muslims from Sulu and Maguindanao carried out raiding expeditions in the Visayas and Luzon to capture slaves for lucrative markets even before the coming of the Spaniards. Did some of those slaves end up in the Malacca bazaars?

It would seem that this is the case because at that time, it was the largest bazaar in this part of the world, a place where traders usually converged to transact their lucrative business for spices and slaves.

If Enrique was not Visayan, why did he understand the language of the people in the Visayas? Today, that would include the Warays, Leyteños (Southern part), Boholanos, and the Cebuanos because these were the areas visited by Magellan’s fleet. I actually asked a friend from Malaysia to speak his native tongue. I wanted to test if Malay and Bisaya are similar. Bisaya is my mother tongue and I could not understand what he was saying. If Enrique was indeed Malay, it is very improbable that he understood Bisaya. My only explanation to this is that he himself was Bisaya.

Therefore, was it a Filipino who first circumnavigated the world?

I would like to leave this question for historians to settle. Maybe it’s time we revisit our history prior to and immediately after the arrival of the Spaniards to get to know more about our past. After all, Filipinos are known all over the world as seafarers and today they form a sizeable percentage of crews of the international shipping industry. Was Enrique the first Filipino international seafarer? Was he the first to circumnavigate the world?

I hope this article ignites interest among our academics to delve deeper into this question. It is fitting that if such is the case, we shall be celebrating 500 years since the first circumnavigation of the world by a Filipino on March 16, 2021. Maybe by then March 16 will be marked as an important date in Philippine calendars.

(This article reflects the personal opinion of the author and does not reflect the official stand of the Management Association of the Philippines. The author is a member of the MAP Agribusiness and Countryside Development Committee, and the Project Manager of the Farm Business School project of MAP and Dean of the MFI Farm Business School. Send feedback to mapsecretariat@gmail.com and renegayo@gmail.com. For previous articles, visit www.map.org.ph.)

source: Buinessworld

Hot emerging markets? The curious case of the Philippines and Mexico

The Aquino administration has very good press these

days—outside the country. In two major international publications, the

Philippines under President Aquino has been the toast and talk of the

town. In early February, Keith Bradsher recently gave a heads up in a

much-read New York Times piece where he wrote: “Political analysts say

that his administration has fought and reduced the corruption that

played a role in holding the Philippines back. In one practical measure

of that change, the country has been able to pave more roads per 100

million pesos in spending (about $2.2 million) than before — when funds

were lost to corrupt officials and incompetence — finally addressing an

impediment to commerce.”

At around the same time, Karen Brooks, writing in January/February issue of Foreign Affairs, claimed that it is no longer Indonesia but the Philippines, “the region’s other archipelago, that is now providing the biggest upside surprise. The Philippine economy expanded by 6.6 percent in 2012, exceeding most economists’ predictions, and was among the fastest-growing economies in the world in the first half of 2013, expanding by 7.6 percent…The Philippine Stock Exchange Index has posted record highs since President Benigno Aquino III came into office in 2010, and approvals for foreign investment have more than doubled in that period. The country’s inflation is low, its foreign exchange reserves are high, and its public debt is steadily declining. As a result, all three of the major credit-rating agencies upgraded Philippine sovereign debt to investment grade in 2013: the first such rating in the country’s history.”

The articles are not uncritical, citing continuing problems of poverty and inequality. But, for the most part they’re very upbeat and provide an interesting balance to the critical opinions rife in the local media.

To be sure, much of the praise is deserved, especially for the president’s crusade for the much-needed Reproductive Health Law, his leadership on the anti-corruption front, and the country’s enviable political stability owing partly to his seemingly unassailable popularity.

But one wonders if there is not also something else going on, especially when one notes how similar assessments are currently being made of Mexico, a country that had been written off as a hopeless “narco-state,” much like the Philippines had been derided as the “poor man of Asia.” In the Feb 24 issue of Time, Michael Crowley writes, “Now the alarms are being replaced with applause. After one year in office, [President Enrique] Pena Nieto has passed the most ambitious package of social, political, and economic reforms in memory. Global economic forces, too, have shifted in his country’s direction. Throw in the opening of Mexico’s oil reserves to foreign investment for the first time in 75 years, and smart money has begun to bet on peso power. ‘In the Wall Street investment community, I’d say that Mexico is by far the favorite nation just now,’ says Ruchir Sharma, head of emerging markets at Morgan Stanley. ‘It’s gone from a country people had sort of given up on to becoming the favorite.’”

These glowing reviews of two economies previously regarded as close to moribund lead one to ask if the judgment of the international business press is something that is based not only on what is actually going in these countries but on what is happening in the global economy.

Three phases of the global economic crisis

The global economy has been in crisis for the last six years. There have been three phases to the crisis. In the first phase, 2008 to 2010, Wall Street’s financial implosion dragged the US economy to deep recession that saw unemployment climb to nearly 10 per cent of the work force. Predictions of sustained recovery have been continually dashed over the last three years, as consumers have preferred not to spend but to save tin order to dig themselves out of the massive debt they accumulated in the years that their unrestricted consumption served engine of the world economy.

The second phase, which began in earnest early in 2010 and intersected with the first phase, was the so-called sovereign debt crisis of the European economies, as international banks panicked at the huge loans they had made to businesses and governments in Southern and Eastern Europe and refused to make further loans until they were paid back. The ensuing austerity programs that were implemented not only in the highly indebted countries but also in troubled Western European economies like Britain and France, practically eliminated Europe as a motor for global recovery.

During this second phase, there were hopes that the so-called BRICS—the acronym for Brazil, Russia, India, China, and South Africa—would fill the void vacated by Europe and the US. While these economies stumbled as a result of the Wall Street implosion in 2008 and 2009, they appeared to have recovered their momentum by 2010, propped up in some cases by massive stimulus spending like China’s $585 billion program, which was the world’s biggest stimulus in relation to the size of the economy and which did shore up its fellow BRICS and many developing economies owing to China’s demand for minerals, raw materials, and manufacturing inputs.

Noble Prize laureate Michael Spence was the most prominent voice of a school that saw the BRICS as the savior of globalization. “The major developing economies have displayed remarkable resilience in the crisis and its aftermath,” he wrote in his 2011 book The New Convergence. “Growth is returning and is already approaching pre-crisis levels in Asia (East and South) and in Latin America, the latter helped in no small measure by the tailwind provided by Asian growth….[T]his growth is sustainable even in the event of slow medium-term growth in the developed countries. The reason is that the size of the emerging market economies taken together is large and growing.”

Spence concluded: “The persistence of growth in the emerging markets is a major positive for the global economy in terms of overall growth and because of the positive impact it will have on the smaller, poorer developing countries. In addition, it will lubricate the structural adjustments in the advanced economies.”

From Brics to Civets

For finance capital seeking a place to dump and speculate on its massive surpluses, they are possible investment havens. For technocrats, academics, and the institutional apparatuses of corporate-driven globalization such as the World Bank and Word Trade Organization, these economies may be the new drivers of growth that would lift the global economy from its six long years of stagnation and crisis.

Around two years ago, when it became clear the Brics could not be relied to sustain global growth, investors coined the term Civets (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa) to denote what they saw as a dynamic new grouping. Since then, however, Egypt and Turkey have fallen off the list owing to political instability and Indonesia and Vietnam have excited less enthusiasm owing to rising nationalism and infrastructure bottlenecks in the case of Indonesia and rising wages and a real estate in the case of Vietnam. Mexico and the Philippines, however, are expected to inject new dynamism to the grouping.

Realities and fantasies

But really, how realistic are the expectations for Mexico and the Philippines of finance capital, which alternates between depression and euphoria and functions with an extremely short time horizon? Is there something solid there beyond the impressive growth rates?

Some dousing of expectations might be in order.

While having some distinctive problems, the most obvious being Mexico’s drug cartels, the two countries have similar structural obstacles to sustained growth. Both have had their manufacturing sectors severely damaged by structural adjustment policies and the flight of capital to low-wage economies.

Both are countries that have agricultural sectors that have been devastated by trade liberalization, the Philippines’ by the World Trade Organization’s Agreement on Agriculture, Mexico’s by the North American Free Trade Area (Nafta). Agrarian reform has stalled in the Philippines and is being reversed in Mexico.

Rent-seeking groups dominate the two economies, with strategic sectors cornered by a few individuals like Carlos Slim, the Mexican telecommunications mogul who was the world’s richest man in 2012, and Manny Pangilinan, the aggressive conglomerate builder who has brought the Philippines’ telecommunications and energy sectors under the control of Indonesia’s Salim family.

What emerge from these harsh realities are countries with severe poverty and inequality. 42 per cent of the population lives below the poverty line in Mexico, and close to 20 per cent in the Philippines. Both are sure to flunk the prime Millennium Development Goal (MDG) test of halving the percentage of their populations living in poverty by 2015.

In terms of inequality, both have terrible profiles, with Mexico’s gini coefficient—the best measure of income inequality—standing at 48.2 and the Philippines at 43. With domestic purchasing power becoming critical as the export markets of the North and the BRICS dwindle owing to the prolonged global stagnation, these are not the statistics that would indicate a capacity to build and sustain a dynamic internal market, much less a global recovery.

Undoubtedly, President Aquino and President Pena Nieto–both scions, incidentally, of prominent political families–have made some advances in turning around their countries’ economies, but the Philippines and Mexico have a long way to go before they can qualify as “hot new emerging markets.” The aura that surrounds them at present reflects less the realities of their economies than the desperate fantasies of international finance capital and the partisans of a failed globalization.

*INQUIRER.net columnist Walden Bello represents Akbayan (Citizens’ Action Party) in the House of Representatives.

At around the same time, Karen Brooks, writing in January/February issue of Foreign Affairs, claimed that it is no longer Indonesia but the Philippines, “the region’s other archipelago, that is now providing the biggest upside surprise. The Philippine economy expanded by 6.6 percent in 2012, exceeding most economists’ predictions, and was among the fastest-growing economies in the world in the first half of 2013, expanding by 7.6 percent…The Philippine Stock Exchange Index has posted record highs since President Benigno Aquino III came into office in 2010, and approvals for foreign investment have more than doubled in that period. The country’s inflation is low, its foreign exchange reserves are high, and its public debt is steadily declining. As a result, all three of the major credit-rating agencies upgraded Philippine sovereign debt to investment grade in 2013: the first such rating in the country’s history.”

The articles are not uncritical, citing continuing problems of poverty and inequality. But, for the most part they’re very upbeat and provide an interesting balance to the critical opinions rife in the local media.

To be sure, much of the praise is deserved, especially for the president’s crusade for the much-needed Reproductive Health Law, his leadership on the anti-corruption front, and the country’s enviable political stability owing partly to his seemingly unassailable popularity.

But one wonders if there is not also something else going on, especially when one notes how similar assessments are currently being made of Mexico, a country that had been written off as a hopeless “narco-state,” much like the Philippines had been derided as the “poor man of Asia.” In the Feb 24 issue of Time, Michael Crowley writes, “Now the alarms are being replaced with applause. After one year in office, [President Enrique] Pena Nieto has passed the most ambitious package of social, political, and economic reforms in memory. Global economic forces, too, have shifted in his country’s direction. Throw in the opening of Mexico’s oil reserves to foreign investment for the first time in 75 years, and smart money has begun to bet on peso power. ‘In the Wall Street investment community, I’d say that Mexico is by far the favorite nation just now,’ says Ruchir Sharma, head of emerging markets at Morgan Stanley. ‘It’s gone from a country people had sort of given up on to becoming the favorite.’”

These glowing reviews of two economies previously regarded as close to moribund lead one to ask if the judgment of the international business press is something that is based not only on what is actually going in these countries but on what is happening in the global economy.

Three phases of the global economic crisis

The global economy has been in crisis for the last six years. There have been three phases to the crisis. In the first phase, 2008 to 2010, Wall Street’s financial implosion dragged the US economy to deep recession that saw unemployment climb to nearly 10 per cent of the work force. Predictions of sustained recovery have been continually dashed over the last three years, as consumers have preferred not to spend but to save tin order to dig themselves out of the massive debt they accumulated in the years that their unrestricted consumption served engine of the world economy.

The second phase, which began in earnest early in 2010 and intersected with the first phase, was the so-called sovereign debt crisis of the European economies, as international banks panicked at the huge loans they had made to businesses and governments in Southern and Eastern Europe and refused to make further loans until they were paid back. The ensuing austerity programs that were implemented not only in the highly indebted countries but also in troubled Western European economies like Britain and France, practically eliminated Europe as a motor for global recovery.

During this second phase, there were hopes that the so-called BRICS—the acronym for Brazil, Russia, India, China, and South Africa—would fill the void vacated by Europe and the US. While these economies stumbled as a result of the Wall Street implosion in 2008 and 2009, they appeared to have recovered their momentum by 2010, propped up in some cases by massive stimulus spending like China’s $585 billion program, which was the world’s biggest stimulus in relation to the size of the economy and which did shore up its fellow BRICS and many developing economies owing to China’s demand for minerals, raw materials, and manufacturing inputs.

Noble Prize laureate Michael Spence was the most prominent voice of a school that saw the BRICS as the savior of globalization. “The major developing economies have displayed remarkable resilience in the crisis and its aftermath,” he wrote in his 2011 book The New Convergence. “Growth is returning and is already approaching pre-crisis levels in Asia (East and South) and in Latin America, the latter helped in no small measure by the tailwind provided by Asian growth….[T]his growth is sustainable even in the event of slow medium-term growth in the developed countries. The reason is that the size of the emerging market economies taken together is large and growing.”

Spence concluded: “The persistence of growth in the emerging markets is a major positive for the global economy in terms of overall growth and because of the positive impact it will have on the smaller, poorer developing countries. In addition, it will lubricate the structural adjustments in the advanced economies.”

From Brics to Civets

Spence’s

book was barely out in 2012 when his Brics began to falter, with the

growth rate of lead economy China dropping from 11 per cent to 7 per

cent. The plunge in China’s BRICS partners was even more drastic, with

Brazil’s growth, at 2.5 per cent in 2013, even lower than sickly

Japan’s, as the Economist pointed out. The problem was that most of the

BRICS had not been able to wean themselves out of dependence on the US

and Europe for their exports. Indeed, respected Chinese technocrat Yu

Yong Ding saw the trends as indicating that China’s “growth pattern has

now almost exhausted its potential.”

For international business, media, and academic establishments

that have been socialized into assuming that globalization is positive

and irreversible, where crises are only bumps on the road to global

prosperity, the prospect of prolonged global stagnation has been deeply

troubling and hard to accept. Thus the search for new “emerging

markets.” Thus economies that would have merely merited a nod at other

periods have become “hot” economies.

For finance capital seeking a place to dump and speculate on its massive surpluses, they are possible investment havens. For technocrats, academics, and the institutional apparatuses of corporate-driven globalization such as the World Bank and Word Trade Organization, these economies may be the new drivers of growth that would lift the global economy from its six long years of stagnation and crisis.

Around two years ago, when it became clear the Brics could not be relied to sustain global growth, investors coined the term Civets (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa) to denote what they saw as a dynamic new grouping. Since then, however, Egypt and Turkey have fallen off the list owing to political instability and Indonesia and Vietnam have excited less enthusiasm owing to rising nationalism and infrastructure bottlenecks in the case of Indonesia and rising wages and a real estate in the case of Vietnam. Mexico and the Philippines, however, are expected to inject new dynamism to the grouping.

Realities and fantasies

But really, how realistic are the expectations for Mexico and the Philippines of finance capital, which alternates between depression and euphoria and functions with an extremely short time horizon? Is there something solid there beyond the impressive growth rates?

Some dousing of expectations might be in order.

While having some distinctive problems, the most obvious being Mexico’s drug cartels, the two countries have similar structural obstacles to sustained growth. Both have had their manufacturing sectors severely damaged by structural adjustment policies and the flight of capital to low-wage economies.

Both are countries that have agricultural sectors that have been devastated by trade liberalization, the Philippines’ by the World Trade Organization’s Agreement on Agriculture, Mexico’s by the North American Free Trade Area (Nafta). Agrarian reform has stalled in the Philippines and is being reversed in Mexico.

Rent-seeking groups dominate the two economies, with strategic sectors cornered by a few individuals like Carlos Slim, the Mexican telecommunications mogul who was the world’s richest man in 2012, and Manny Pangilinan, the aggressive conglomerate builder who has brought the Philippines’ telecommunications and energy sectors under the control of Indonesia’s Salim family.

What emerge from these harsh realities are countries with severe poverty and inequality. 42 per cent of the population lives below the poverty line in Mexico, and close to 20 per cent in the Philippines. Both are sure to flunk the prime Millennium Development Goal (MDG) test of halving the percentage of their populations living in poverty by 2015.

In terms of inequality, both have terrible profiles, with Mexico’s gini coefficient—the best measure of income inequality—standing at 48.2 and the Philippines at 43. With domestic purchasing power becoming critical as the export markets of the North and the BRICS dwindle owing to the prolonged global stagnation, these are not the statistics that would indicate a capacity to build and sustain a dynamic internal market, much less a global recovery.

Undoubtedly, President Aquino and President Pena Nieto–both scions, incidentally, of prominent political families–have made some advances in turning around their countries’ economies, but the Philippines and Mexico have a long way to go before they can qualify as “hot new emerging markets.” The aura that surrounds them at present reflects less the realities of their economies than the desperate fantasies of international finance capital and the partisans of a failed globalization.

*INQUIRER.net columnist Walden Bello represents Akbayan (Citizens’ Action Party) in the House of Representatives.

Spain eyes PHL as next investment hub in Asia

Spain is now looking to the Philippines as the best hub to establish its presence in Asia in preparation for the Asean Economic Community in 2015, and cited infrastructure as a viable area of investment.

“I think the

Philippines is the best hub we can think of to introduce our companies

and our economy in Asia, and I hope that we can find good partners to

start business in this part of the world,” said Spanish Minister for

Foreign Affairs and Cooperation Jose Manuel Garcia-Margallo at the

Makati Business Club (MBC) General Membership Meeting at the Mandarin

Oriental Hotel.

This message comes at

the heels of the economic recovery of Spain, which, according to

Margallo, was among the European countries hardest hit by the global

financial crisis.

Among the blows that

the Spanish economy has experienced are a dramatic fall of its gross

domestic product, high public deficit and a growing public debt.

However, with the

significant fiscal reforms undertaken by the country in the past years,

Spain is now changing its model based on enhanced competitiveness,

productivity and export-driven, Margallo said.

Gross domestic product

growth and employment rates are improving, as well as public deficit,

Margallo reported and is looking to Asia, the Philippines, in

particular, to be the next investment hub.

“That is why this

important Spanish business delegation is here, to explore and take

advantage of all the things that the Philippines may offer to Spain,” he

said.

Peter Angelo V.

Perfecto, executive director of the MBC, revealed that with the Asean

economic integration in 2015, Spain is looking to the Philippines as a

possible hub from which Spanish economic presence can take hold in the

rest of Asia.

Perfecto added that

the 25-member Spanish business delegation presently in the Philippines

will undertake meetings with Philippine companies, led by the Ayala

Group.

The

MBC official added in a chance interview after the forum that the

Spanish delegation is eyeing infrastructure development, in particular,

as 37 percent of the whole transport infrastructure in the world is

managed by Spanish companies.

“We are exploring

possibilities in many areas, but since the Philippines is aiming to have

good infrastructure in order to attract investments to the country,

infrastructure is one area that Spanish companies are especially

qualified in,” said another Spanish trade official during the open

forum.

Socioeconomic Planning Secretary Arsenio M. Balisacan, who also attended the forum, welcomed Spain’s interest in infrastructure development and additionally called attention to tourism, agribusiness and industrial manufacturing as ripe opportunities for Spanish businessmen.

The Spanish firms

making rounds with their Philippine counterparts are engaged in various

sectors but are mostly in infrastructure and tourism.

To solidify the

commitment between Spain and the Philippines in developing business

relations for both sides, a memorandum of agreement was signed on Monday

between two business groups in Spain—the High Council of Chambers of

Commerce, Industry and Navigation of Spain, and the Confederation of

Employers and Industries of Spain—and the Makati Business Club.

According to data from

the Department of Trade and Industry, bilateral trade between Spain and

the Philippines grew by 19 percent from 2010 to 2012, or from $304

million to $362 million, and is the Philippines’s seventh-largest

trading partner in Europe.

Bilateral trade between the two countries as of the first semester of 2013 is valued at $225 million.

In terms of tourism,

17,000 Spaniards have visited the Philippines in 2013, up by 7.7 percent

from 2012, according to Department of Tourism statistics, while

Filipino visitors to Spain were pegged at 50,000 in 2013.

Thursday, March 20, 2014

How can we trust Asean integration?

THE Asia News Network

website posted this headline on March 11: “Asean [the Association of

Southeast Asian Nations] displays solidarity as region suffers.” The

commentary accompanying it noted that Malaysia’s neighbors responded

without hesitation to the missing Malaysia Airlines Flight MH370, saying

this “is testing relations and cooperation among Asean friends and

partners.”

Differences, if any,

were set aside in order to focus on finding the plane. Each Asean member

gathered whatever resources it has at its disposal to help, even if it

has nothing at gain from it, except more goodwill. This is true for the

Philippines, which had no citizens on board that plane.

It was a proper and

humane response to a baffling incident that any country would appreciate

and any regional bloc would expect from its members. But as the days

pass, a darker side to the search-and-rescue effort emerges that may

have long-term consequences.

Like business

relationships, the progress to Asean economic integration—which will

take a major leap next year—is based on trust. In the past, regional

partnerships have been secured with threats, with one country forcing a

partnership to serve its objectives. The Roman Empire comes to mind; so

does the Greater East Asia Co-Prosperity Sphere in the early 1940s, when

Japan “liberated” its neighbors from Western economic influence.

The Asean integration

plan is modeled, in part, on the efforts of European nations to create

the European Union (EU). While the Asean initiative has yet to go as far

as EU integration has, the principles are basically the same. Some

measure of national sovereignty is being sacrificed by individual

countries in the hopes that a union will provide more economic benefits

than every nation trying to earn them by itself.

EU members have

discovered that trust is a primary foundation of the union. After the

banking and financial crisis struck Greece, it was learned that Athens

had lied about its financial affairs in order to join the EU. The Greek

government understated its debt to reach the fiscal benchmarks necessary

for full EU membership. Other EU nations suffered as a result of that.

While other Asean

members were spending huge sums of money—and putting lives on the

line—searching for Flight MH370, it appeared that the Malaysian

government was not completely honest with them. Consider: The search was

concentrated on the last-known point of contact, but it turns out the

Malaysian authorities knew full well that the plane had already turned

westward and reached Malaysia’s eastern coast.

Are the other Asean

members going to express confidence that their co-members will be

trustworthy in dealing with some details of Asean integration, such as

passport and employment-credential control? Are we going to be

comfortable with the potential integration of the region’s stock

markets, with the regulators of other nations auditing their companies’

financial records?

The Bible says if a

person cannot be trusted with minor matters, how much more with major

ones. Malaysia has failed the first practical Asean integration test.

source: Business Mirror

Wednesday, March 19, 2014

The Strength of Retail: in a Wider ASEAN Economy

| Date: 03.19.2014 |

| Place: Mandarin Manila, Makati City |

| Occasion: CTB Annual Convention |

| Speaker: Governor Amando M. Tetangco, Jr. |